Variable Annuities

A Plan for Your Future

If you’re seeking to secure your financial future beyond your working years, you have many options for saving and investing your money. But when it comes to long-term planning, certain investments let you save on a tax-deferred basis.

Combine tax deferral with the long-term growth potential inherent in stock and bond investments and you have an alternative that can help you build the retirement assets you’ll need – a variable annuity.

Variable annuities offer a remarkable combination of tax-advantaged growth opportunities and protection including:

- Tax deferral. You pay no current income tax on earnings or other taxable amounts until you make a withdrawal. At that time, it’s important to be aware that withdrawals of taxable amounts are subject to income tax and, if taken prior to age 59 ½, a 10% federal tax penalty may apply.1

- Potential for long-term growth of your money. You’re able to invest in professionally managed investment portfolios.

- Valuable guarantees. These include protection for beneficiaries and choices for income you cannot outlive.

The questions and answers that follow will help you understand more about the valuable role variable annuities can play in your retirement planning.

1Tax-qualified contracts such as IRAs, 401(k)s and others are tax-deferred regardless of whether they are funded with an annuity. However, annuities do provide other features and benefits including, but not limited to, a guaranteed death benefit (based on the claims-paying ability of the issuer) and income choices, for which a mortality and expense risk is charged.

What is a Variable Annuity?

A variable annuity is a contract between you – the annuity owner – and a life insurance company. In return for your purchase payment, the insurance company agrees to provide either a regular stream of income or a lump-sum payout at some future time, generally when you retire.

How Does it Work?

A variable annuity has an accumulation phase and an income phase. The accumulation phase begins as soon as you invest. Your purchase payment(s) can be invested in the securities portfolios and fixed interest options that are available in your contract. Unlike a mutual fund, where interest, dividends and/or capital gains are taxed each year, any growth in an annuity accumulates on a tax-deferred basis. Of course, your investment can also lose value.

When you are ready to take distributions, typically at retirement, you can choose to have your principal and interest paid out in the form of income payments – called annuitization – or you can take systematic withdrawals or receive a lump sum payout.

What Do I Receive for my Purchase Payments?

For each purchase payment you make, you receive “accumulation units” in the insurance company’s separate account. The separate account purchases shares in professionally managed investment portfolios. The performance of your investment does not depend on the performance of the insurance company’s assets. Only the performance of the investment options you have chosen will affect your results. Each unit’s value or “price” is determined by the value of the investment portfolio, less any insurance charges, divided by the number of units outstanding.

Some annuities now credit investors with payment enhancements on their purchase payments, putting more dollars to work for you up front. Generally, in exchange for the payment enhancement, you’ll accept a higher surrender charge and/or a longer period of time over which the surrender charge applies. These enhancements are generally based on a certain percentage – such as 2%, 3% or 4% of a premium – and are normally added as earnings to the contract. Details of these features are found in each annuity’s prospectus.

How Will Tax Deferral Affect My Investment?

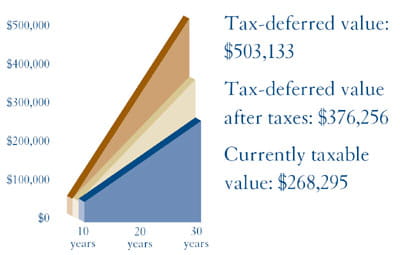

Tax deferral can allow the value of your annuity to potentially grow faster than that of a comparable taxable investment. This graph shows the advantages of tax-deferred compounding, assuming a $50,000 investment at an 8% rate of return over 30 years, and a 28% marginal tax bracket.

This chart does not reflect the fees and charges associated with any particular investment. Such expenses would lower overall returns. Although annuities typically include a mortality and expense risk charge of 1.25%, an asset based administration fee of 0.15%, a contingent deferred sales charge which starts at 7% in the first year and decreases 1% each year until it reaches 0%, and an annual contract charge of $30, these charges are not reflected in the hypothetical performance. If they had been reflected, the ending values of the tax-deferred investment would be lower. Gains in the taxable investment may be taxed at a lower capital gains tax rate. Lower maximum tax rates on capital gains and dividends would make the investment return for the taxable investment more favorable, thereby reducing the differences in performance between the accounts shown. You should consult with your tax advisor regarding your particular tax responsibilities and circumstances. This chart is for illustrative purposes only and is not intended to imply or represent a guarantee of any specific return on any particular investment. Please see your financial advisor for performance information of specific investments. Investment results fluctuate and can decrease as well as increase. Withdrawals of taxable amounts are subject to income tax and, if taken prior to age 59 1/2, a 10% federal tax penalty may apply. Early withdrawals may be subject to withdrawal charges. Partial withdrawals may also reduce benefits available under the contract as well as the amount available upon a full surrender.

What is the Difference in Taxation for Taxable and Tax-Deferred Investments?2

When you invest in a currently taxable investment, like a mutual fund, any dividends or interest you earn during the year are taxable, even if you reinvest the dividends. Mutual funds can earn money for an investor in several ways, which can be taxed at different rates. Capital gains may be taxed at a capital gains tax rate that is lower than the income tax rate; dividends and interest are generally taxed at income tax rates.

Many investors may not realize that if you sell an investment that has had any gains, or if the mutual fund money manager sells a security that results in a distribution to you, you may owe capital gains taxes.

Variable annuities are insurance alternatives whose gains accumulate tax-deferred and are taxed as ordinary income when withdrawn. When you invest in a variable annuity, any growth is credited to your account but is not taxed until you take distributions, at or near retirement.

In a variable annuity, when you make a withdrawal, you’ll owe income taxes at your then current tax rate on any portion of the withdrawal that is considered earnings. For tax purposes, interest is always considered to be withdrawn first, so unless you begin to exhaust principal, you may owe taxes on the full amount of your withdrawal. In addition, because the IRS set up tax-deferral rules in order to encourage Americans to save for retirement, if you make a withdrawal before age 59 1/2, you’re likely to owe a 10% federal tax penalty on the amount withdrawn.

With an annuity, if the contract owner dies the beneficiary will owe income taxes only on the taxable portion of the death benefit. Special rules apply to spousal beneficiaries, allowing for continuation of the tax-deferred status of the contract in addition to other settlement options.

The beneficiary of a currently taxable investment does not pay income taxes on the earnings received. If you purchase your annuity in a traditional qualified plan such as an IRA or Keogh account, different tax rules apply. Generally, the full amount of any withdrawal, even an amount attributed to principal, is taxable because in a qualified plan the contributions to the annuity are made on a pre-tax basis. Please consult with your tax advisor for additional information.

2 There are many distinctions between mutual funds and variable annuities. For instance, mutual funds serve various short- and long-term financial needs, while variable annuities are designed specifically for long-term retirement savings. Unlike mutual funds, variable annuities include insurance features for which you pay certain fees and charges, including mortality and expense charges and a contract administration fee. Mutual funds and variable annuities each have unique features, benefits and charges, and you should discuss the appropriateness of any investment for your particular situation with your financial advisor.

Why is it Called a ‘Variable’ Annuity?

“Variable” refers to the fact that the contract value and/or income generated by the underlying investment options is not fixed. Your return will vary due to market conditions and prevailing interest rates.

What Types of Securities do the Portfolios Contain?

The majority of variable annuities let you choose among portfolios of stocks, bonds and money market alternatives. You can allocate your money among different portfolios, depending upon how aggressive or conservative you wish to be.

Who Decides Exactly What I Invest In?

You choose the investment options in which you will invest from among those offered in your contract. The insurance company issuing the annuity develops relationships with one or more professional money managers, who decide which specific stocks and bonds will be a part of each investment option. Most variable annuities offer you several different money management firms and multiple investment options within one alternative.

Why Should I Invest in Securities Through a Variable Annuity?

- Diversification. A variable annuity offers you the opportunity to diversify your portfolio across a broad range of investment options, asset classes and money management styles, all within a single investment alternative.

- Switching privileges. Most variable annuities permit you to reallocate your money among the investment options. Transfers among investment options within the annuity are not taxable, but they may be subject to a transfer charge.

- Insurance guarantees:

- Guaranteed death benefit. The insurance company generally guarantees that in the event of death before the income phase (annuitization) begins, your beneficiary will receive the greater of (a) the entire amount of your premiums less an adjustment for withdrawals, charges and fees, or (b) the current contract value. Some companies offer more generous benefits that allow for a guaranteed increase in the premium amount, a step-up in the guaranteed death benefit value at certain contract years or the opportunity to potentially increase your death benefit value by a percentage of earnings at the time of the owner’s death. There may be an additional fee for these benefits. Read the prospectus for the variable annuity you choose to find out exactly what type of death benefit the alternative offers, as well as its associated costs.

- Fixed-interest options. Most annuities also let you allocate funds to one or more fixed-interest options in which the insurance company guarantees your interest rate.

- Income for life. If you chose to “annuitize,” you can be guaranteed an income that lasts as long as you live.

- Minimum guaranteed income. Some variable annuities guarantee a minimum level of income during retirement – no matter what happens in the financial markets. This minimum level is usually based on the amount of your contributions less an adjustment for withdrawals. Income protection features such as these can give you the confidence to invest in the higher growth potential of equities, knowing that when you annuitize your contract your retirement income will never go below the minimum level. If your investments have performed well, you receive the higher income based on your actual contract value.

- Return of principal amount. Some annuities provide a special program in which the insurance company guarantees return of an amount representative of your premium regardless of the actual performance of the underlying investments. The principal may be returned in a lump sum at some future time or through systematic withdrawals lasting a specified period. Please note that these features do not guarantee the performance of any variable options in the contract and may require that you hold your contract a minimum number of years before you may take advantage of the guarantee. Withdrawals also reduce benefits and values. There may be an additional fee for these benefits.

Can I Have Access to My Money Before I’m 59½?

Yes. Most variable annuities provide for withdrawal of a specified amount during the accumulation phase, free of company-imposed charges.

Withdrawals in excess of the amount specified are possible, but may trigger surrender charges. Again, all withdrawals of taxable amounts are subject to income tax, and if you are younger than age 59 ½, the IRS may also impose a 10% federal tax penalty.

You may also encounter a “market value adjustment,” or MVA, if you take money out of fixed-interest options before the end of the interest-rate guarantee period.

The MVA reflects any difference in the interest rate environment between the time you place your money in the fixed account option and the time when you withdraw the money. This adjustment can increase or decrease your contract value.

Finally, be aware that some annuities allow you to make systematic withdrawals from your contract, which can provide you a regularly scheduled income during the accumulation phase. Systematic withdrawals are generally subject to the same tax rules as other withdrawals and must cease upon annuitization.

What Does ‘Annuitize’ Mean?

A contract is “annuitized” when it converts from an accumulation phase to an income phase, and the owner or other payee(s) receive(s) periodic annuity payments. Most companies offer several annuity payment options, based primarily on how long you want the income to last.

How is the Amount of My Payment Determined if I Annuitize?

The amount of each payment will depend on where your money is allocated – for example, funds in a fixed account will generate a fixed payment; funds in a variable portfolio will generate a variable payment – what annuity option is selected, and your age and gender. Meanwhile, the undistributed portion of your investment can continue to compound, tax-deferred.

Am I Taxed Differently on Annuity Payouts than on Withdrawals?

Yes. Once you have annuitized, each payment is structured as a partial return of principal and part interest. If you have only contributed after-tax money to the annuity, only the interest portion of the payment is taxable. You should consult your financial advisor and/or tax advisor before deciding to annuitize. See above for a discussion of taxation rules on withdrawals made before you annuitize.

What Should I Consider When Selecting a Variable Annuity?

- Historical performance of the portfolios. While not a guarantee of future results, historical performance should tell how well the annuity’s investment managers have done in both positive and adverse markets.

- Fees and charges. Carefully review details on the fees and charges of the contract, and available benefits. These are provided in the annuity’s prospectus.

- Soundness of the insurance company. All guarantees, such as death benefits, income protection, among others, are backed by the insurance company’s claims-paying ability. Most companies are rated by independent industry analyst A.M. Best Company and may also be rated by Standard & Poor’s and Moody’s Investors Service. Your financial advisor can give you information on the ratings of companies whose annuities he or she is recommending.

How Can I Find Out Whether an Annuity is Right for Me?

Ask your financial advisor to review your circumstances and determine if an annuity is appropriate for you. Consider the annuity’s unique advantages:

- Tax deferral

- Professional management

- Diversification

- Retirement income you cannot outlive

- No cap on how much you can invest

- Death benefits

You’ll see why variable annuities can be a valuable alternative in today’s economic and tax environment.

Investors should consider the investment objectives, risks, and charges and expenses of variable annuities carefully before investing. The prospectus contains this and other important information about the variable annuity and its underlying funds. Prospectuses for both the variable annuity contract and the underlying funds are available from your Raymond James financial advisor and should be read carefully before investing.

Variable annuities are long-term investment alternatives designed for retirement purposes. Withdrawals of taxable amounts are subject to income tax, and if taken prior to age 59 ½, a 10% federal tax penalty may apply. Early withdrawals may be subject to withdrawal charges. Partial withdrawals may also reduce benefits available under the contract as well as the amount available upon a full surrender. An investment in the securities underlying variable annuities involves investment risk, including possible loss of principal. Your contract, when redeemed, may be worth more or less than the total amount invested. Past performance is no guarantee of future results.

The purchase of a variable annuity is not required for, and is not a term of, the provision of any banking service or activity. Variable annuities are not federally insured by the Federal Deposit Insurance Corporation (FDIC), Federal Reserve Board or any other government agency and are not a deposit of, guaranteed by, endorsed by, or an obligation of any federal banking institution.

Not FDIC or NCUA/NCUSIF insured • No bank or credit union guarantee • May lose value

Information on this page is provided courtesy of AIG SunAmerica, one of the nation’s largest annuity providers.

For advice concerning the tax treatment of variable annuities and for complete, up-to-date details on tax law, consult a qualified tax advisor. For additional information and the variable annuity prospectus(es) of your choice, please contact your financial advisor.