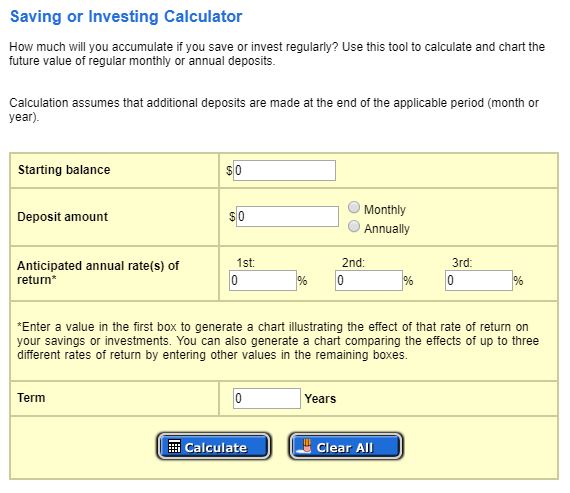

Benefits of Spending Less

Reducing your spending can be worth more than you might think. Use this calculator to see just how much your budget reductions may be worth, if you were to invest them. Visit the value of this new potential nest egg both with and without taxes factored in.

While this calculator can provide you with some insight, it was developed to be very general and may not fit everyone’s personal situation. Please feel free to contact our office after using this calculator so we can perform a more thorough analysis.

Definitions

Monthly savings

The total amount you could invest per month by spending less. The amount is calculated by adding up your potential entertainment budget and utility savings.

Annual rate of return

This is the annually compounded rate of return you expect from your investments. The actual rate of return is largely dependent on the type of investments you select. For example, from December 200 to December 2010, the annual compounded rate of return for the S&P 500 was 0.899 percent, including reinvestment of dividends. From January 1970 to December 2010, the average annual compounded rate of return was approximately 10.05 percent (source: www.standardandpoors.com). Since 1970, the highest 12-month return was 61 percent (June 1982 through June 1983). The lowest 12–month return was -43 percent (March 2008 to March 2009). Savings accounts at a bank may pay as little as one percent or less, but carry significantly lower risk of loss of principal balances.

It is important to remember that these scenarios are hypothetical and that the future rates of return can’t be predicted with certainty, and that investments that pay higher rates of return are generally subject to higher risk and volatility. The actual reate of return on investments can vary widely over time, especially for long-term investments. This includes the potential loss of principal on your investment. It is not possible to invest directly into an index and the compunded rate of return noted above does not reflect sales charges and other fees that funds and/or investment companies may charge.

Years to Save

The total number of years you plan to save.

Federal tax rate

The federal tax rate you expect to pay on taxable investments.

State tax rate

The state tax rate you expect to pay on taxable investments.

Total savings before taxes

Total value of your savings before taxes are taken into account. Most regular savings accounts and investment accounts are taxable. However, if your savings is being invested into a tax deferred or tax-free investment, this total may be important to you.

Total savings after taxes

The total amount you would have accumulated in a taxable account. All taxes are assumed to be paid as your earnings accrue.